Renters should be enrolled in Spring Guard Surge Protect

If a customer calls and indicates they are a renter (not a homeowner), and their account is incorrectly enrolled in the Plumbing or HVAC program, please follow these steps to correct the enrollment.

1. Update Program Enrollment

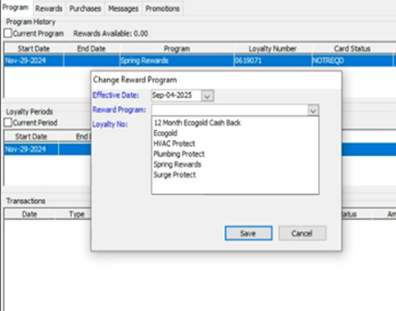

Go to Loyalty/Ecogold in the system.

Click the edit icon on the far right of the screen.

A second screen will appear. From the list of programs, select

Click on the edit icon located on the far right of the screen.

A second screen will appear. Select Surge Protect from the list of programs.

Click Save to confirm the changes.

2. Inform the Customer

Notify the customers that there program has been updated to the Surge Protect program, which is designed specifically for renters.

Highlight the benefits of this program. This can also serve as a retention tool if the customer is considering cancellation.

3. Document the Update

After saving the changes, be sure to leave a note in the system using the "Account Information Update" call reason.